Our Blog

Diamond

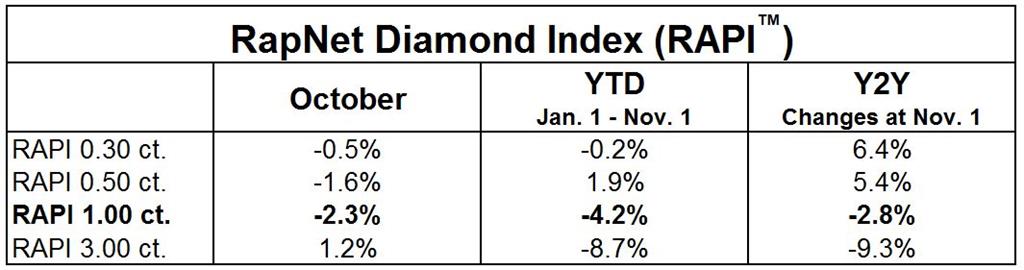

Prices Decline in October

PRESS RELEASE, November 1, 2016, New York…

Diamond markets were quiet in October with wholesale businesses closing for the

respective Chinese, Jewish and Indian holidays. Trading slowed as larger U.S.

holiday orders were already filled and dealers shifted to accommodate specific

requirements from their retail customers.

The RapNet Diamond Index (RAPI™) for one-carat, RapSpec-A3+ polished diamonds

fell 2.3% in October. The index dropped 4.3% in the first ten months of the year.

Market sentiment improved after the September

Hong Kong show but polished trading remained sluggish and inventory levels

relatively high. Rough demand softened as rough prices firmed in October and

Indian diamond manufacturers scaled down operations before closing for

Diwali.

Market sentiment improved after the September

Hong Kong show but polished trading remained sluggish and inventory levels

relatively high. Rough demand softened as rough prices firmed in October and

Indian diamond manufacturers scaled down operations before closing for

Diwali.

While rough demand slowed in October, mining companies continue to register

strong growth compared with 2015 when demand slumped due to low manufacturing

profitability and high polished inventory. De Beers sales volume rose 90% in

the third quarter, while ALROSA’s increased 69%.

Manufacturing profits remain tight due to sluggish polished demand, while rough

trading was relatively strong in the third quarter. India’s rough imports

soared 54% to $4.2B in the third quarter, a record for the period, while its

polished exports grew 15% to $6.1B.

The industry’s focus shifted to retail as Diwali, Christmas and the Chinese New

Year provide important jewelry selling opportunities in the major consumer

markets. We expect moderate U.S. jewelry sales growth this Christmas, relative

stability in China but weakness in Hong Kong, while reports signal steady gold

sales in India during Diwali.

However, holiday jewelry sales are unlikely to stimulate a sustainable rise in

diamond trading and polished prices are expected to remain under pressure for

the rest of 2016 and into 2017. That should cause rough prices to soften in the

long term. With sufficient stock in the midstream, the diamond trade continues

to re-align its inventory with lower levels of demand while there is still an

overhang of supply from previous years.